Asked by

Ashwin Angammal

on Oct 23, 2024

Verified

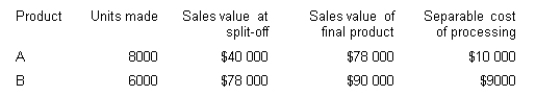

Lipex Pty Ltd produces two products (A and B) from a particular joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Joint production costs for the year were $60 000. Sales values and costs are as follows.

Allocate the joint production costs based on the physical units method. What are the joint costs assigned to product A?

A) $25 714

B) $20 339

C) $34 286

D) $30 000

Physical Units Method

A technique in accounting used to measure output in production or inventory in terms of the total number of units.

Joint Production Costs

Costs incurred in the process where two or more products are produced together and the costs cannot be readily assigned to individual products.

- Investigate the intricacies of joint production, how costs are jointly shouldered, and the economic implications of opting for further processing or selling immediately at split-off.

Verified Answer

SR

Learning Objectives

- Investigate the intricacies of joint production, how costs are jointly shouldered, and the economic implications of opting for further processing or selling immediately at split-off.

Related questions

Which of These Statements About Joint Cost Allocation Is False ...

The Method Under Which the Relative Magnitude of the Final ...

A Chocolate Company Uses the Weight of Joint Products as ...

Product Costs Incurred After the Split-Off Point Are Called ...

The Carter Corporation Makes Products a and B in a ...