Asked by

Kuldeep Singh

on Oct 11, 2024

Verified

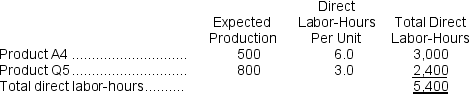

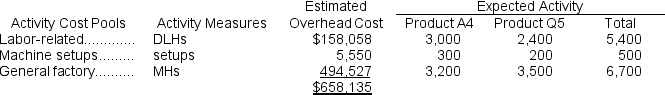

Salvatori, Inc., manufactures and sells two products: Product A4 and Product Q5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product A4 under activity-based costing is closest to:

The overhead applied to each unit of Product A4 under activity-based costing is closest to:

A) $506.26 per unit

B) $654.66 per unit

C) $472.38 per unit

D) $731.28 per unit

Activity-Based Costing

An accounting method that identifies the activities that a firm performs and then assigns indirect costs to products based on the benefit received from those activities.

- Familiarize oneself with the foundational principles and application of activity-based costing (ABC).

- Determine the rates for overhead and employ this determination to assess product costing within Activity-Based Costing.

Verified Answer

NB

Learning Objectives

- Familiarize oneself with the foundational principles and application of activity-based costing (ABC).

- Determine the rates for overhead and employ this determination to assess product costing within Activity-Based Costing.