Asked by

Verified

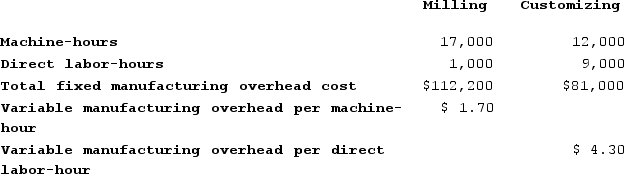

Kroeker Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job T898. The following data were recorded for this job:

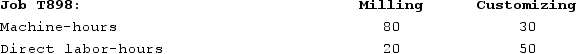

During the current month the company started and finished Job T898. The following data were recorded for this job:

The amount of overhead applied in the Customizing Department to Job T898 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Customizing Department to Job T898 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $450.00

B) $119,700.00

C) $665.00

D) $215.00

Overhead Applied

The portion of overhead costs that are allocated to products or cost objects based on a predetermined overhead rate.

Customizing Department

A segment within a manufacturing or service company dedicated to modifying products or services to meet specific customer requests or needs.

Job-Order Costing System

A cost accounting system that assigns costs to specific production batches or jobs, used in custom or unique product manufacturing.

- Allocate manufacturing overhead to specific jobs based on relevant activity bases.

Verified Answer

Learning Objectives

- Allocate manufacturing overhead to specific jobs based on relevant activity bases.

Related questions

Barbeau Corporation Has Two Production Departments, Milling and Customizing ...

The Amount of Overhead Applied in the Machining Department to ...

The Amount of Overhead Applied in the Customizing Department to ...

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...