Asked by

Jewel Kyle Arbas

on Oct 10, 2024

Verified

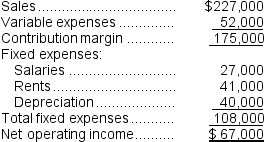

(Ignore income taxes in this problem.) Olinick Corporation is considering a project that would require an investment of $343,000 and would last for 8 years.The incremental annual revenues and expenses generated by the project during those 8 years would be as follows:  The scrap value of the project's assets at the end of the project would be $23,000.The cash inflows occur evenly throughout the year.The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $23,000.The cash inflows occur evenly throughout the year.The payback period of the project is closest to:

A) 3.0 years

B) 5.1 years

C) 3.2 years

D) 4.8 years

Incremental Annual Revenues

The additional revenues generated over a year from a particular action or decision, often considered in investment or project analysis.

Scrap Value

The estimated residual value of an asset at the end of its useful life, often considered when calculating depreciation.

Cash Inflows

Money received by a business from various sources, including operations, investment, and financing activities.

- Absorb the method and ascertain the payback duration for investment propositions.

Verified Answer

TD

Learning Objectives

- Absorb the method and ascertain the payback duration for investment propositions.