Asked by

LGmashups - Lily Gilbert

on Nov 01, 2024

Verified

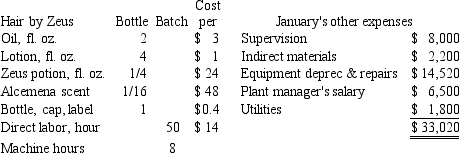

Hercules Hair Restorer Inc.(HHRI) makes many varieties of hair restoration products which are sold under well-known marketing labels.A single batch contains 10,000 8-oz.bottles and takes two days to make.Typically 15 batches are completed per month,for different brands.Basic cost data for the month of January appears below.  HHRI appoints a new CEO,who decides to increase production targets to 200 batches per year.She also hires a management accountant who decides to apply fixed overhead based on normal capacity and does some research into cost behavior.Basic product data still applies.New information appears below.

HHRI appoints a new CEO,who decides to increase production targets to 200 batches per year.She also hires a management accountant who decides to apply fixed overhead based on normal capacity and does some research into cost behavior.Basic product data still applies.New information appears below.

Estimated overhead for year % fixed Supervision $96,000100% Indirect materials $30,80060% Equipment depreciation $126,240100% Equipment repairs $48,00030% Plant manager’s salary $84,500100% Utilities $27,000‾20%$412,540‾‾\begin{array}{llr}\text { Estimated overhead for year } & &{\% \text { fixed }} \\\text { Supervision } & \$ 96,000 & 100 \% \\\text { Indirect materials } & \$ 30,800 & 60 \% \\\text { Equipment depreciation } & \$ 126,240 & 100 \% \\\text { Equipment repairs } & \$ 48,000 & 30 \% \\\text { Plant manager's salary } & \$ 84,500 & 100 \% \\\text { Utilities } &\underline{\$ 27,000} & 20 \% \\& \underline{\underline{\$ 412,540}} &\end{array} Estimated overhead for year Supervision Indirect materials Equipment depreciation Equipment repairs Plant manager’s salary Utilities $96,000$30,800$126,240$48,000$84,500$27,000$412,540% fixed 100%60%100%30%100%20% If HHRI uses a plant-wide rate based on a single cost pool,which of the following statements is true? (Do not round your intermediate calculations. )

A) The overhead rate is $35.564 per hour

B) If machine hours are used as the cost driver,the overhead rate is $41.254 per hour

C) If machine hours are used as the cost driver,the full cost per bottle is $19.676

D) If direct labor hours are used as the cost driver,the full cost per batch $196,762.70

E) (c) and (d) only

Cost Pool

A grouping of individual costs, typically by department or service center, from which cost allocations are made later.

Machine Hours

A measure of production time, quantifying the total hours a machine is operated within a specific period.

- Ascertain the contribution of direct labor hours and machine hours to the determination of product pricing and distribution of overhead costs.

- Acquire knowledge on the core concepts of absorption costing and the procedure for applying overhead expenses to products.

Verified Answer

KR

Learning Objectives

- Ascertain the contribution of direct labor hours and machine hours to the determination of product pricing and distribution of overhead costs.

- Acquire knowledge on the core concepts of absorption costing and the procedure for applying overhead expenses to products.

Related questions

Elison Corporation, Which Has Only One Product, Has Provided the ...

Aaron Corporation, Which Has Only One Product, Has Provided the ...

Ross Corporation Produces a Single Product ...

Levron Corporation Uses a Job-Order Costing System with a Single ...

The Net Operating Income (Loss)under Absorption Costing in Year 2 ...